An Update on Long-Term Performance of Stocks, Bonds, Cash, Real Estate, and Gold

January 14, 2025 - 23:14

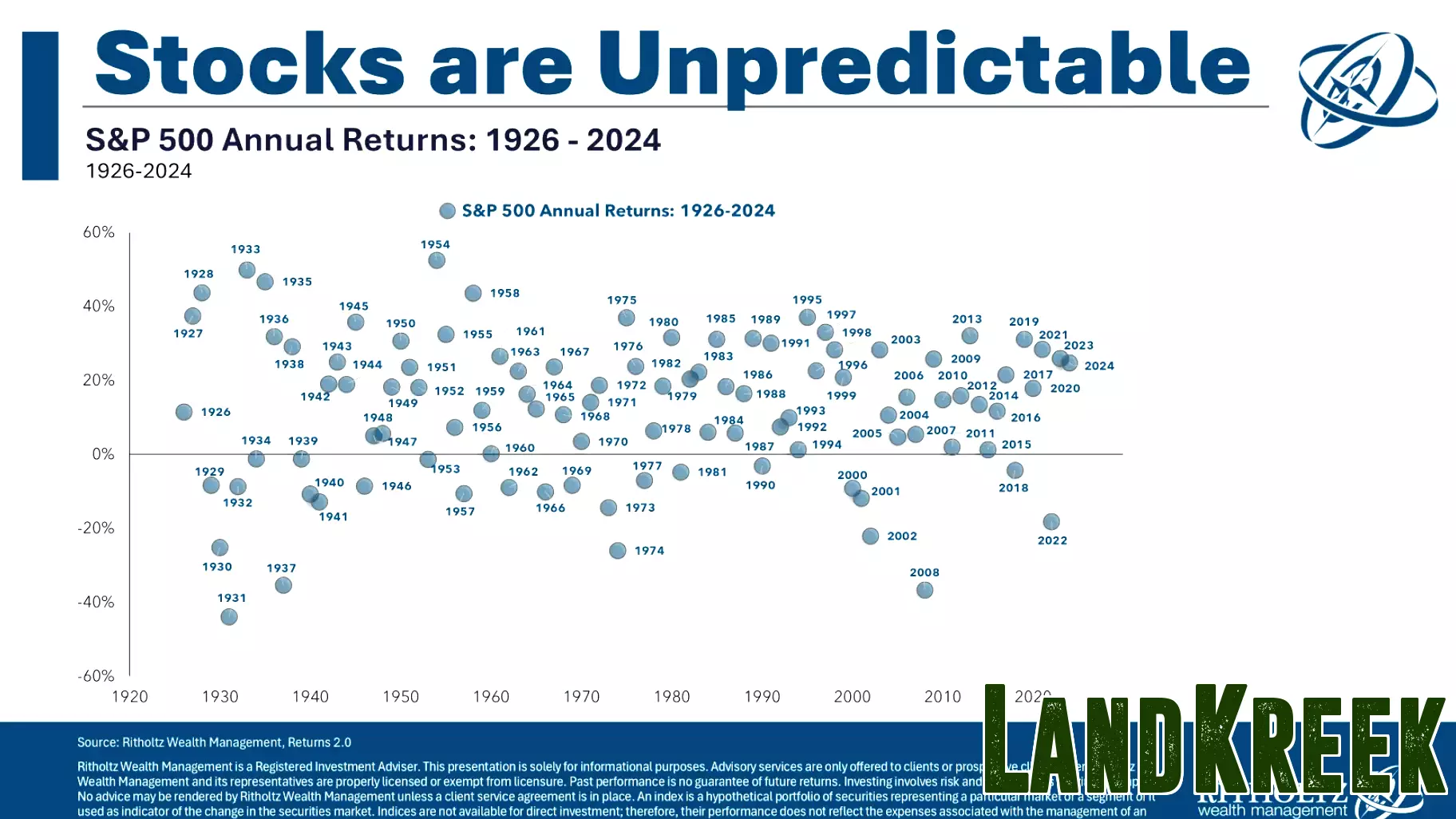

Recent analyses have shed light on the long-term performance of various asset classes, including stocks, bonds, cash, real estate, and gold. Historically, stocks have demonstrated the highest returns over extended periods, making them an attractive option for investors seeking growth. The average annual return for equities has consistently outperformed other asset types, although it comes with higher volatility.

Bonds, on the other hand, have provided more stability and lower returns compared to stocks. They are often seen as a safer investment, particularly during economic downturns. Cash, while offering liquidity and security, tends to yield the lowest returns, especially in a low-interest-rate environment.

Real estate has proven to be a solid long-term investment, benefiting from both appreciation and rental income. It often acts as a hedge against inflation. Gold, historically viewed as a safe haven, has shown its value during times of economic uncertainty, but its long-term returns can be more inconsistent compared to other asset classes.

Overall, understanding the historical performance of these assets can help investors make informed decisions in their portfolio allocations.

MORE NEWS

March 9, 2026 - 19:46

Rare Chapel Hill property near UNC hits market for millionsA rare and sizable development opportunity has emerged in Chapel Hill, with a key 1.24-acre property near the University of North Carolina campus now on the market. The land`s value is...

March 9, 2026 - 05:32

Berks County real estate transactions for March 8A new set of real estate transactions has been officially recorded in Berks County, providing a snapshot of local property movement. The filings, documented in the county`s recorder of deeds office...

March 8, 2026 - 01:44

9 Best Places to Retire in Virginia, According to Real Estate ExpertsFor those envisioning a peaceful and fulfilling retirement, Virginia presents an array of exceptional towns and cities to call home. According to insights from real estate experts, the state`s...

March 7, 2026 - 00:37

Reflecting On Consumer Discretionary - Real Estate Services Stocks’ Q4 Earnings: CBRE (NYSE:CBRE)The fourth-quarter earnings season for consumer discretionary real estate services stocks revealed an industry navigating a complex landscape of high interest rates and shifting transaction volumes...